What is GMV and why everyone loves it? In the retailer reports, you can often see the data on GMV growth over time, especially for the BNPL companies. Let’s figure out what it is and why it is required. The indicator GMV (Gross Merchandise Value or gross value of goods) is the total value of […]

Blog

Today we’d like to discuss the following topic: Why the future is about multi-offer solutions and how marketplaces empower consumers? It seems to be an obvious trend to see more and more services being constructed around one or another type of Marketplace. However, the number of parties against this tendency is also staying sufficient. So […]

We are pleased to announce that JO1N has officially been accepted to the UK Financial Conduct Authority (FCA)’s Regulatory Sandbox which allows firms to test innovative offerings in a live environment. More information on the FCA’s sandbox can be found here. As part of the sandbox, we will be part of cohort 7 and will […]

In this article, you will learn how, as a consumer credit firm you can apply open banking data to understand borrowers better in these uncertain times. The consumer credit landscape is changing rapidly due to globalization and pandemics making it impossible for lenders to continue business as usual while still relying on traditional credit bureau […]

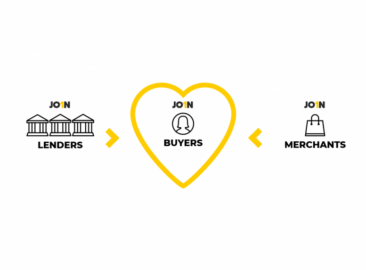

Our holistic approach Attempting to offer the cheaper credit option for the buyers and SME businesses at the same time requires deep expertise in dealing with merchants of such size. We have experience in dealing with SME’s and strategy in place to bring that “right at the checkout” lending comparison tool to the UK, so […]

Frankly speaking, there are many reasons to join if you are a buyer and want to have a smooth shopping experience, boost the sales of your store or get reliable borrowers for your lending organisation. But here is a list of few: Benefits for buyers It’s Quick. Sign up is smooth, don’t spend another minute […]

Buy now, pay later is a simple concept: instead of buyers paying at the till or online checkout, the BNPL provider pays the retailer for the buyer. The buyer then agrees to pay the BNPL provider back over a few weeks or months, meaning the buyer can spread out buyer shopping costs. It simply means […]